Introduction

Every prescribed person (withholding agent) shall file a withholding tax statement for each quarter under Section 165 of the Income Tax Ordinance, 2001 showing all the particulars of the payee (from whom withholding tax was deducted/collected) such as:

Table of Contents

- Name of payee

- CNIC/NTN of payee

- Address of payee

- Amount and nature of payment

- Tax withheld/collected along with applicable section.

Timing of Withholding Tax Statement Section 165

The withholding tax statement will be filed quarterly as given.

- For Jan-March quarter By 20th April

- For April-June quarter By 20th July

- For July-September quarter By 20th October

- For October-December quarter By 20th January

Filing of Withholding Tax Statement Section 165(1)

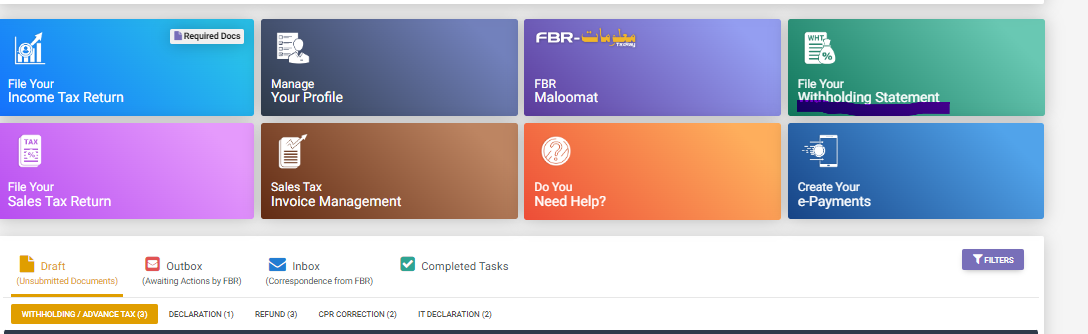

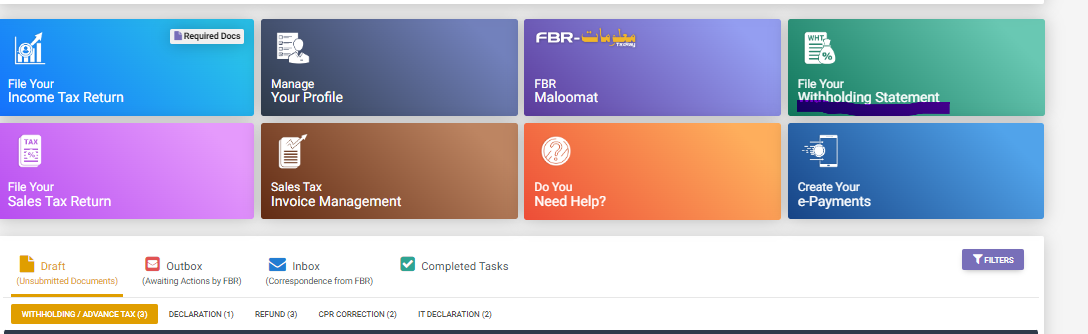

The original withholding tax statement is filed under Section 165(1) of the Income Tax Ordinance 2001 through FBR IRIS portal. The withholding tax details can be entered manually or MS Excel file containing data/details can be uploaded.

Uploading Excel File

A withholding agent can upload the MS Excel file containing withholding tax deducted and collected data in the format given below:

MS Excel file should pass through the validation test of FBR IRIS portal otherwise, the file will not be uploaded. For this purpose, the withholding agent should ensure that all the information such as CNIC/NTN was entered in a proper format. All the data entered should have supporting CPRs.

Filing of Revised Statement Section 165(2A)

A prescribed person/withholding agent can file a revised withholding tax statement under Section 165(2A) of the Income Tax Ordinance, 2001 to rectify any error in the original withholding tax statement filed under Section 165(1) within sixty days of filing of such statement. The revised statement is filed through the same icon on FBR IRIS as for original statement.

Filing of Annual Withholding Tax Statement Section 165(6)

Every prescribed person/withholding agent shall file annual withholding statement for tax deducted on payment of salary under Section 149 of the Income Tax Ordinance, 2001. This statement is filed through the same icon on FBR IRIS as for original statement.

Filing of Annual Withholding Tax Statement Section 165(7)

A person who files a quarterly withholding tax under Section 165 (1) or a revised withholding tax statement under Section 165 (2) of the Income Tax Ordinance, 2001 shall also e-file an annual withholding tax statement within thirty days of the end of the tax year.

Reconciliation Withholding Tax under Section 165 (8)

A person who files annual withholding tax statement under Section 165 (7), shall also e-file an annual statement reconciling the withholding tax declared in annual withholding statement with the tax declared in annual income tax return, audited accounts and financial statements by the due date of filing of Income Tax Return.

Furnishing of Information by Banks Section 165A

Every banking company shall furnish the following information to the Federal Board of Revenue every month in a manner and form as prescribed by the Board:

- detail of persons who withdrew cash exceeding fifty thousand Rupees in a day and tax deductions thereon aggregating to Rupees one million or more.

- detail of deposits made during the month equal to ten million or more during the preceding month.

- list of payments made by a person against credit card equal to Rs.200,000 or more.

- persons receiving profit on debt and tax deducted on such profit during the preceding year.

- particulars of business accounts opened during the previous month.

Information Provisions by Banks and Financial Institutions Section 165B

Every banking company and financial institution shall provide information to the Board about non-resident persons for the purpose of automatic exchange of information under bilateral agreement or multilateral convention.

Penalty for Non-Filing of Withholding Statement

As per Section 182 of the Income Tax Ordinance, 2001 the penalty for non-filing of the withholding tax statement shall be:

- Rs. 5,000 if the tax deducted or withheld was deposited within due date and withholding tax statement was filed within ninety days of the due date of the filing of such statement.

- In other cases Rs. 2,500 per day from the day of default subject to the minmum penalty of Rs. 10,000

- Where no tax is involved, the minimum penalty shall be Rs.10,000.