Introduction

Payment of withholding tax to the Commissioner, is the responsibility of a prescribed person (withholding agent) under Section 160 of the Income Tax Ordinance 2001 as specified in the Income Tax Rules 2002.

Table of Contents

According to the Rule 43 of the Income Tax Rules 2002, a withholding agent shall pay to the Commissioner by way of credit to the Federal Government as given below:

- the tax deducted or collected by the Federal or Provincial Government on the same day;

- the tax deducted or collected by other persons by depositing in the authorized branch of the State Bank of Pakistan or National Bank of Pakistan within seven days of the week ending on Sunday. *For instance, if a tax is deducted on Thursday (the 4th of a month), it shall be deposited by Saturday (the 13th of the same month) next following Sunday.

Payment of Withholding Tax Procedure

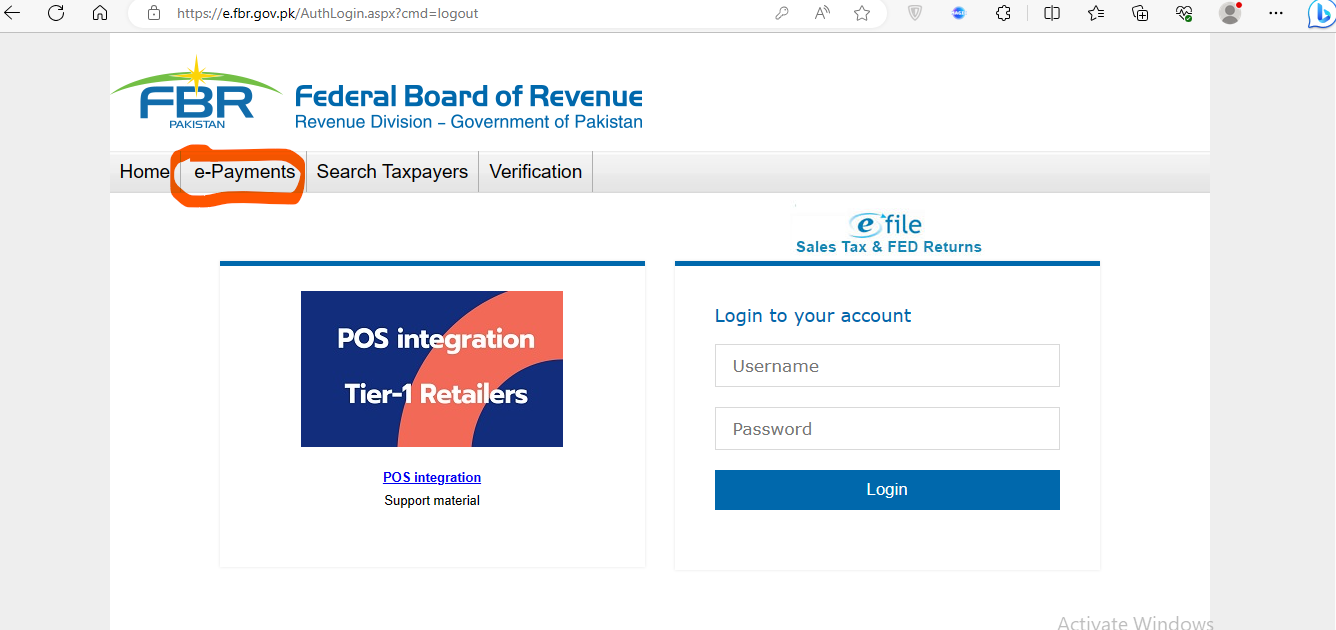

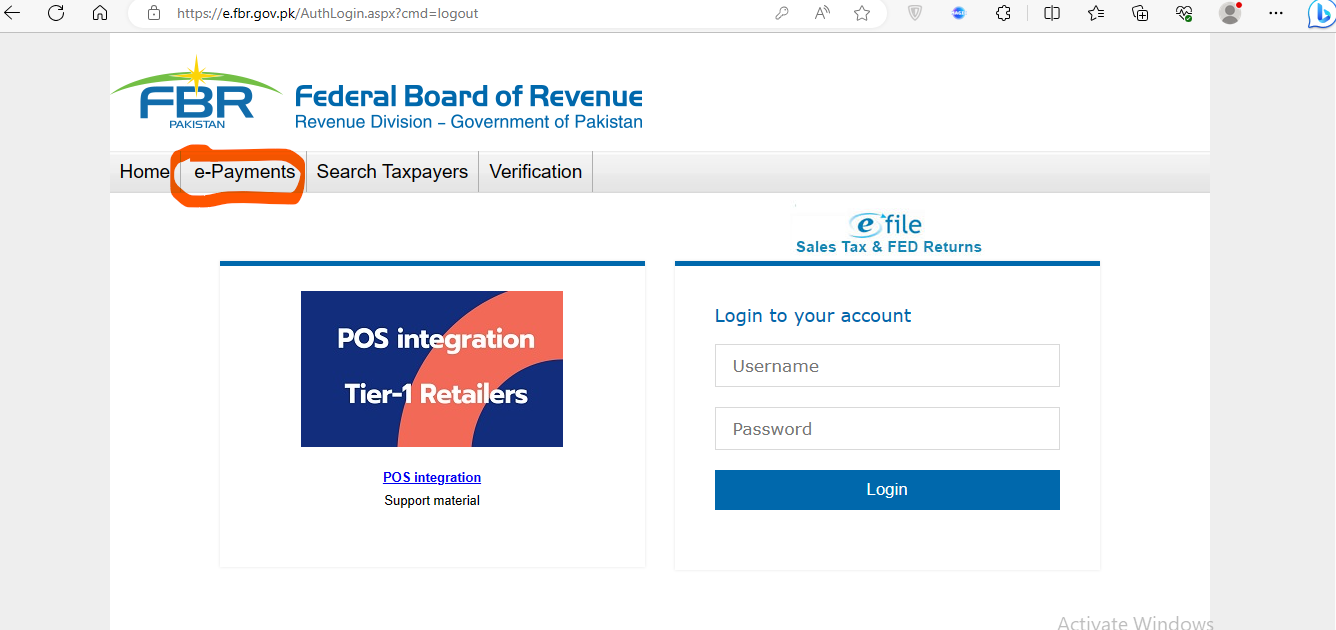

A prescribed person/withholding agent will pay withholding tax by generating Payment Slip ID at eFBR – Taxpayer Facilitation Portal by clicking the e-payments tab and then income tax.

It will lead to the following window:

By filling all the relevant fields, the withholding agent will click on Create tab. The payment challan will be generated as given below:

The withholding agent will deposit the relevant tax amount in the designated branch of State Bank or National Bank of Pakistan after signing and stamping. The bank will generate Computerized Payment Receipt (CPR).

Liability of Payment of Withholding Tax

- According to the Section 161 of the Income Tax Ordinance, 2001, where a person required to deduct or collect a tax does not do so or does not deposit such tax after deduction or collection of the same as required under Income Tax Ordinance, such a person will be personally liable for the payment of withholding tax to the Commissioner.

- The Commissioner can recover the such tax after passing an Order by giving an opportunity to the said person of being heard. However, the prescribed person (Withholding agent) liable for payment of withholding tax has right to appeal.

- However, if it is established that the tax has been paid in the meantime by the person from whom such tax should have been deducted or collected, the Commissioner shall recover only default surcharge at the 12% from the person responsible for deduction and payment of withholding tax.

- As per Section 161 (2), the person responsible for deduction and payment of withholding tax can recover the tax from the person from whom such tax should have been deducted or collected.

- Under Section 162 (1) of the Income Tax Ordinance, 2001, the Commissioner IR can recover the tax due from the person from whom the tax should have been collected by the prescribed person/withholding agent. However, the prescribed person/withholding agent who has failed to collect tax, will be liable to pay default surcharge or disallowance of deduction of the relevant expense.

- According to Section 164, the withholding agent will provide the copies of Computerized Payment Receipts (CPRs) to the person from whom tax was collected.

Payment of Withholding Tax by a SWAP Agent

- The Federal Board of Revenue (FBR) can require a prescribed person/withholding agent to integrate with Synchronized Withholding Administration and Payment System and declare such a person as SWAP agent for collection or deduction of income tax in digital mode under Section 164A of the Income Tax Ordinance, 2001.

- The SWAP agent will issue SWAP Payment Receipt (SPR) to the person from whom tax was collected or deducted, instead of CPR.

- If a notified SWAP agent fails to integrate with Synchronized Withholding Administration and Payment System, such person shall not be entitled to a tax credit, under Income Tax Ordinance, 2001.