Introduction

Introduction

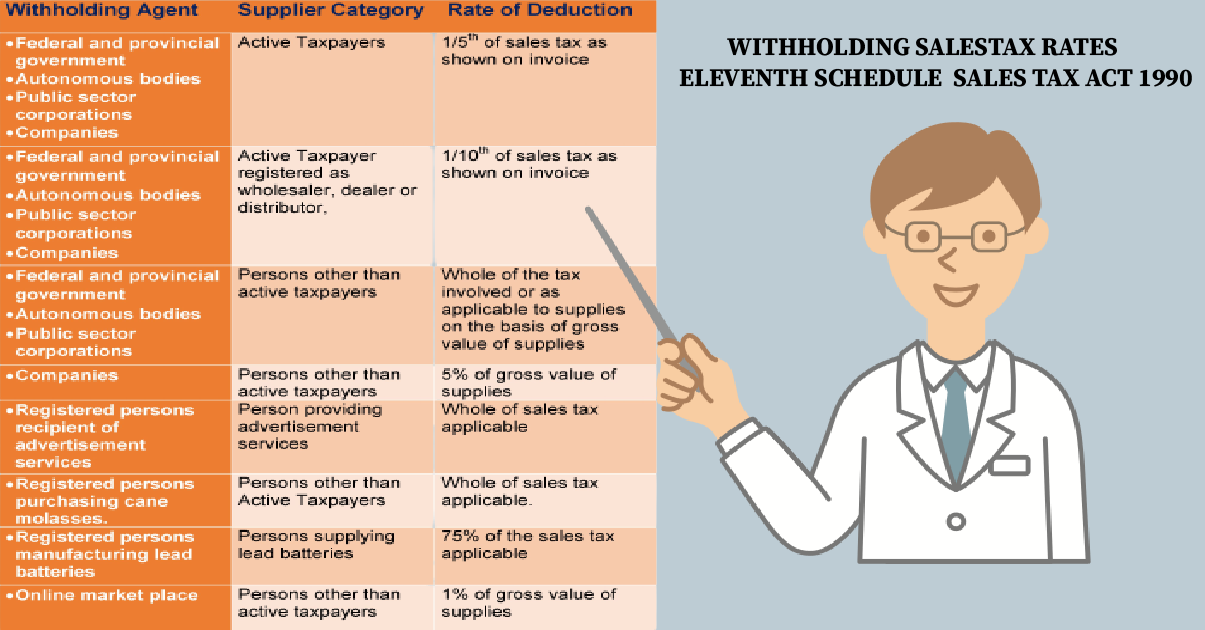

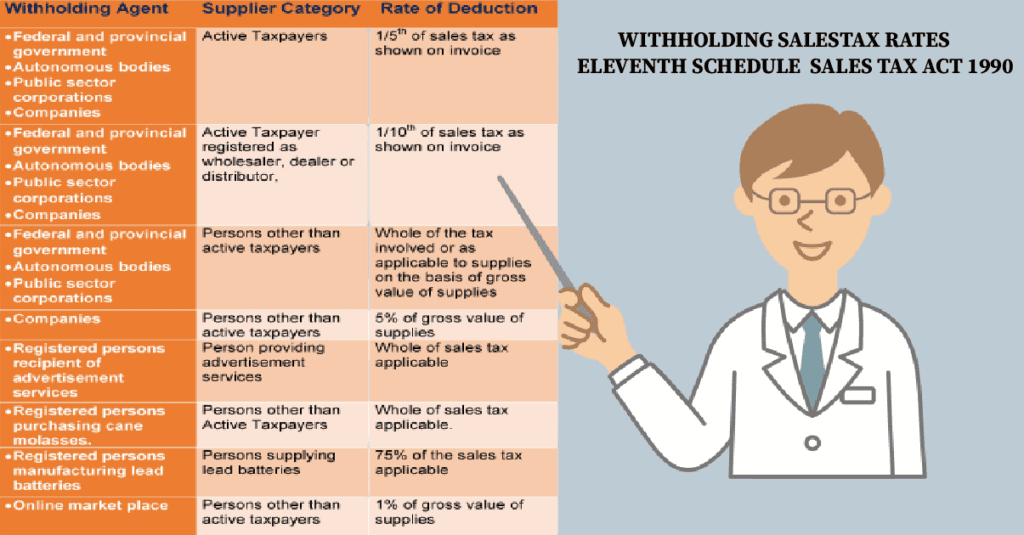

The Eleventh Schedule of the Sales Tax Act, 1990 describes the rates for withholding of sales tax in accordance with the Section 3(7) of the Sales Tax Act, 1990.

Table of Contents

Withholding Sales Tax Rates Under Eleventh Schedule

Active Taxpayers

Under Eleventh Schedule the Federal and provincial government departments; autonomous bodies; and public sector organizations and Companies as defined in the Income Tax Ordinance, 2001 will withhold 1/5th of Sales Tax as shown on sales invoice issued by an Active Taxpayer.

Example

If an institution or person (buyer) as mentioned above purchases goods valuing Rs. 1000 involving sales tax Rs. 170 from an active taxpayer (supplier). The buyer will withhold 1/5th of the sales tax (Rs.170/5 = Rs. 34) and will pay the remaining amount including sales tax (Rs.1000+134= Rs.1134) to the supplier. The buyers will deposit the sales tax in government treasury and provide the proof of such payment to the supplier.

Active Taxpayers-Wholesaler, Dealer or Distributor

The Federal and provincial government departments; autonomous bodies; and public sector organizations and Companies as defined in the Income Tax Ordinance, 2001 will withhold 1/10th of Sales Tax as shown on sales invoice issued by an Active Taxpayer registered as a wholesaler, dealer or distributor.

Example

If an institution or person (buyer) as mentioned above purchases goods valuing Rs. 1000 involving sales tax Rs. 170 from an active taxpayer (supplier). The buyer will withhold 1/10th of the sales tax (Rs.170/5 = Rs. 17) and will pay the remaining amount including sales tax (Rs.1000+153= Rs.1153) to the supplier. The buyer will deposit the sales tax in government treasury and provide the proof of such payment to the supplier.

Persons Other than Active Taxpayers

Government Organizations

The Federal and provincial government departments; autonomous bodies; and

public sector organizations will withhold whole of the sales tax involved or as applicable to supplies on the basis of gross value of supplies received from a person other than an active taxpayer.

Example

If an institution or person (buyer) as mentioned above purchases goods valuing Rs. 1000 from a person (supplier) who is not an active taxpayer. The buyer will withhold the sales tax Rs.170 and will pay Rs.1000 to the supplier. The buyer will deposit the sales tax in government treasury and provide the proof of such payment to the supplier.

Companies

The Companies as defined in the Income Tax Ordinance, 2001, excluding companies exporting surgical instruments, will withhold 5% of gross value of supplies received from a person who is not an active taxpayer.

Example

If an institution or person (buyer) as mentioned above purchases goods valuing Rs. 1000 from a person (supplier) who is not an active taxpayer. The buyer will withhold 5% of Rs. 1000= Rs. 50. The buyer will deposit the sales tax in government treasury and provide the proof of such payment to the supplier.

Purchase of advertisement services

In case of registered persons receiving advertisement services whole of sales tax will be withheld.

Purchase of cane molasses

In case of registered persons purchasing cane molasses from persons other than active taxpayers whole of sales tax will be withheld.

Persons supplying lead batteries

80% of sales tax applicable will be withheld.

Online market place

As per provisions of the Eleventh Schedule, at an online market place 1% of the gross value of supplies will be withheld from a person who is not an active taxpayer.

Suppliers of Gypsum

Registered manufacturers of cement shall withhold 80% of the sales tax applicable from suppliers of gypsum or limestone flux.

Coal Suppliers

A registered person shall withhold 80% of the sales tax applicable from suppliers of coal.

Suppliers of Waste Paper and Paper Board

A registered person shall withhold 80% of the sales tax applicable from suppliers of waste paper and paper board.

Suppliers of Plastic Waste

A registered person shall withhold 80% of the sales tax applicable from suppliers of plastic waste.

Suppliers of Crush Stone and Silica

A registered person shall withhold 80% of the sales tax applicable from suppliers of crush stone and silica.

Exemptions under Eleventh Schedule of Sales Tax Act 1990

The withholding of sales tax under Eleventh Schedule shall not be applicable to the following goods and supplies:

- Electrical energy;

- Natural Gas;

- Petroleum Products as supplied by petroleum production and exploration companies, oil refineries, oil marketing companies and dealers of motor spirit and high speed diesel;

- Vegetable ghee and cooking oil;

- Telecommunication services;

- Goods specified in the Third Schedule to the Sales Tax Act, 1990;

- Supplies made by importers who paid value addition tax on such goods at the time of import;

- Supplies made by an Active Taxpayer as defined in the Sales Tax Act, 1990 to another registered persons with exception of advertisement services, supply of lead, gypsum, coal, waste paper, paper board, plastic waste, and crush stone and silica.

- Supply of sand, stone, gravel/crush and clay to low cost housing schemes sponsored or approved by Naya Pakistan Housing and Development Authority.

Conclusion

The significance of the Eleventh Schedule of the Sales Tax Act, 1990 regarding withholding sales tax cannot be overlooked as it presents the rates and exemptions for withholding sales tax. The purchaser will withhold sales tax from payment to supplier at the applicable rates with certain exceptions as described in the Sales Tax Act 1990 and will deposit the same in government treasury as prescrcibed in Sales Tax Special Procedures (Withholding) Rule 2007.

FAQs

Q. What is Eleventh Schedule of Sales Tax 1990?

Ans. Eleventhe Schedule of Sales Tax Act, 1990 describes withholding sales tax rates under Sales Act 1990.

Q. When was Eleventh Schedule inserted in Sales Tax Act 1990?

Ans. Eleventh Schedule was inserted in Sales Tax Act 1990 through Finance Act 2019.

Q. What is withholding sales rate for supplies made by active taxpayers?

Ans. The supplies made by active taxpayers are exempt from withholding sales tax with exception of advertisement services, supply of lead, gypsum, coal, waste paper, paper board, plastic waste, and crush stone and silica.

Q. What is withholding sales rate for supplies made by persons other than active taxpayers, under Eleventh Schedule of Sales Tax Act 1990?

Ans. In case of purchase of Federal and provincial government departments; autonomous bodies; and public sector organizations the whole of the sales tax involved will be withheld.

In case of purchases made by companies from persons other than active tax payers, 5% of gross value of supplies will be withheld.

Q. What is withholding sales tax rate for supply of goods mentioned in Third Schedule of Sales Tax Act, 1990?

Ans. The supply of goods mentioned in Third Schedule of Sales Tax Act, 1990 is exempt from withholding unders Eleventh Schedule of Sales Tax Act 1990.

P.S. For any further questions/queries please refer to the comment section.

Introduction

Introduction