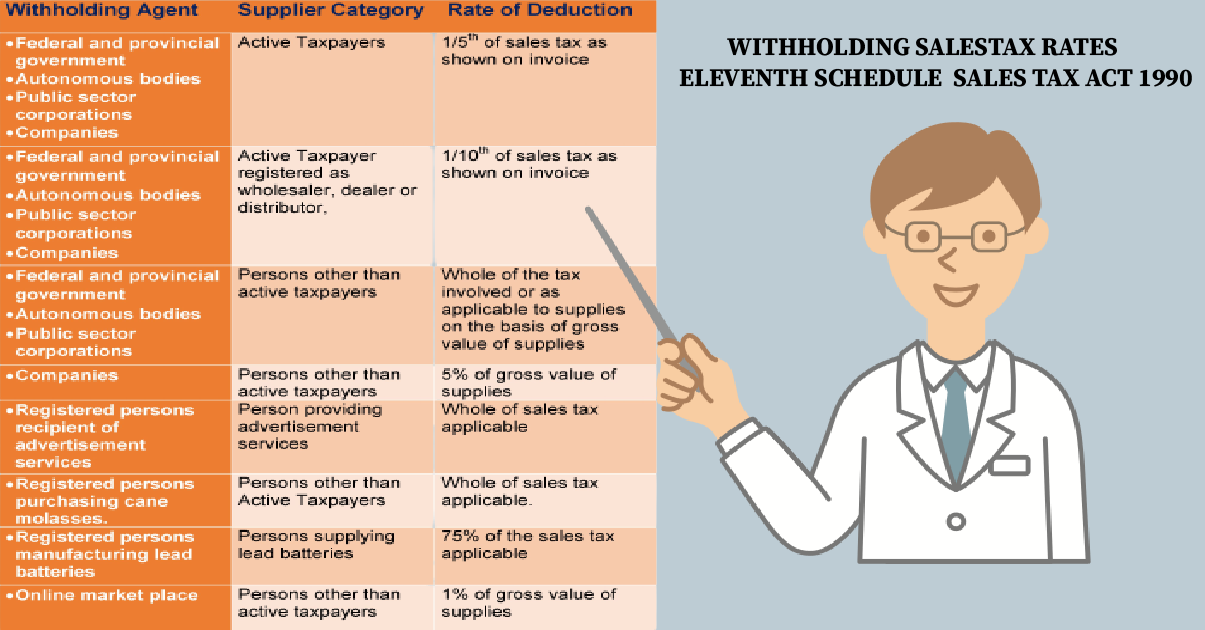

Resident Withholding Tax Rate Section 153

Introduction The resident withholding tax rate is applied in accordance with the Division III of Part III of the First Schedule of the Income Tax Ordinance, 2001. Categorywise Resident Withholding Tax Rate Resident withholding tax rates under Section 153 of the Income Tax Ordinance, 2001 are as given below: Description Categories Rate Goods-Section 153(1)(a) Sale … Read more