Deemed Income Section 7E

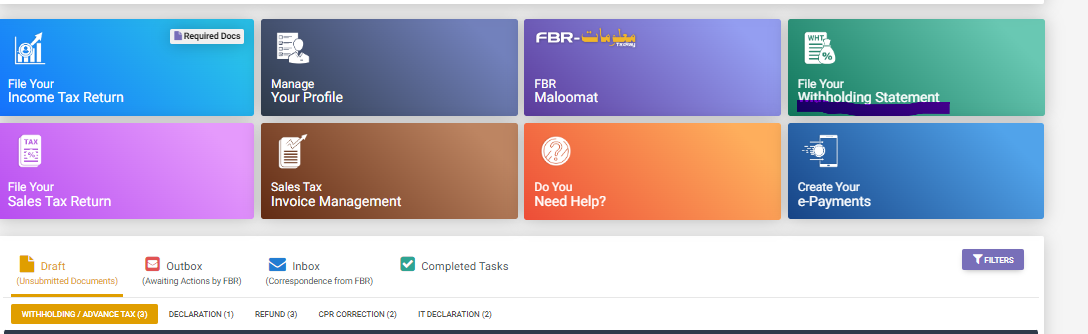

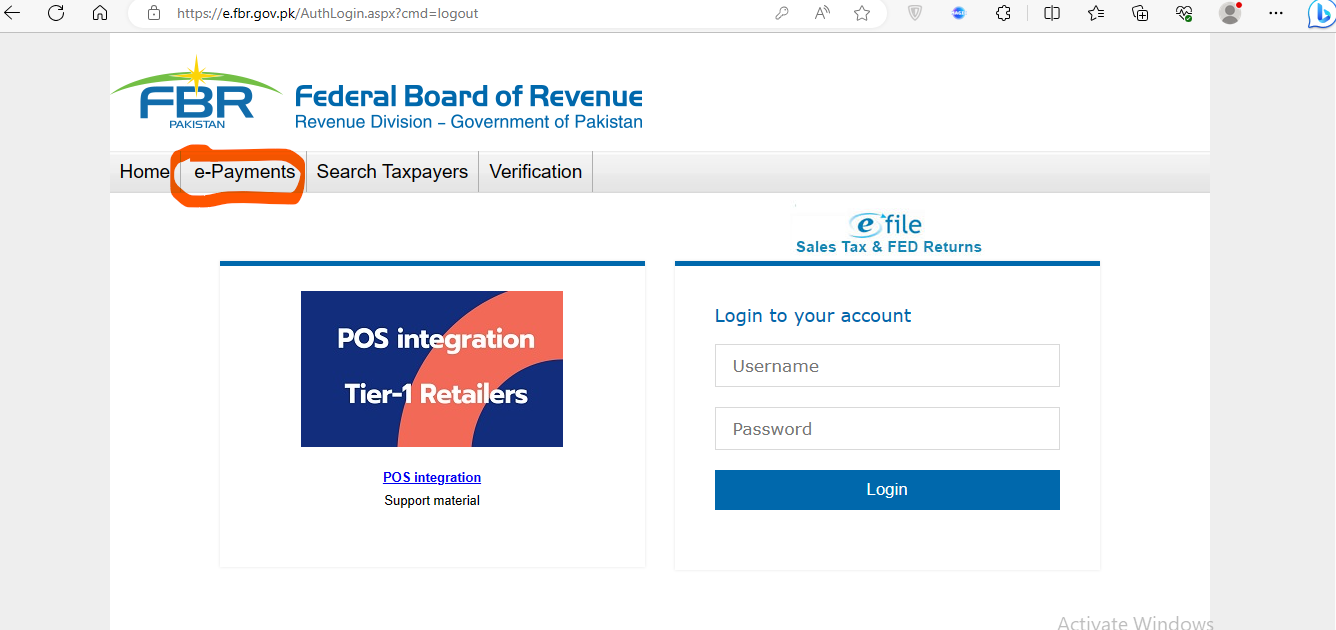

Introduction The concept of deemed income Section 7E of the Income Tax Ordinance 2001 means that if a person owns capital assets defined as given below such person shall be deemed or considered to earn an income equal to 5% of fair market value of such capital asset. Hence, such income will be subject to … Read more